Image commercially licensed from Unsplash

Starting a business necessitates meticulous financial planning as well as strategic decision-making. A credit card is an important tool that can greatly help entrepreneurs from the start. While some people are hesitant to incur credit card debt, when used wisely, credit cards provide various benefits that can promote business growth and streamline financial operations. In this post, we’ll go over six convincing reasons why you should get a credit card right away as you start your business.

- Establishing Business Credit

You can create a unique credit profile for your business by getting a credit card in its name. A solid credit history is crucial for your company’s long-term financial stability and potential for future growth. You can improve your company’s creditworthiness and perhaps qualify for larger loans, more palatable interest rates, and better conditions in the future by making on-time payments and keeping a low credit utilization ratio.

- Separating Personal and Business Expenses

You may keep your personal and corporate funds separate by using a specific business credit card. This category simplifies bookkeeping and tax preparation of your business-related expenses. Additionally, it makes it possible for you to track and monitor your business expenditures more effectively, which makes it simpler to analyze cash flow, find tax deductions, and properly manage your budget.

- Managing Cash Flow

It’s common for cash flow to fluctuate during the early stages of a business, with times when spending is high, and payments are slow. The use of a credit card can be an effective means of bridging these cash flow gaps. During tight times, using a credit card for required company purchases will help you keep operations running smoothly, pay suppliers and vendors on time, and take advantage of opportunities that require quick action. It gives you a safety net and enables you to fulfill financial obligations without interfering with your business operations.

- Building Rewards and Benefits

Numerous business credit cards include rewards programs that are specially designed to meet the demands of business owners. Based on your company expenditure areas, such as office supplies, advertising, or travel, these programs can net you rewards in the form of points, cashback, or other incentives. By strategically using your credit card for business spending, you can earn points that you can put back into your company or use to get personal advantages like gift cards or reduced travel. The value you get from your spending can be increased by selecting a credit card with benefits that are in line with your company’s demands. You should do a credit card comparison before availing credit card for your business.

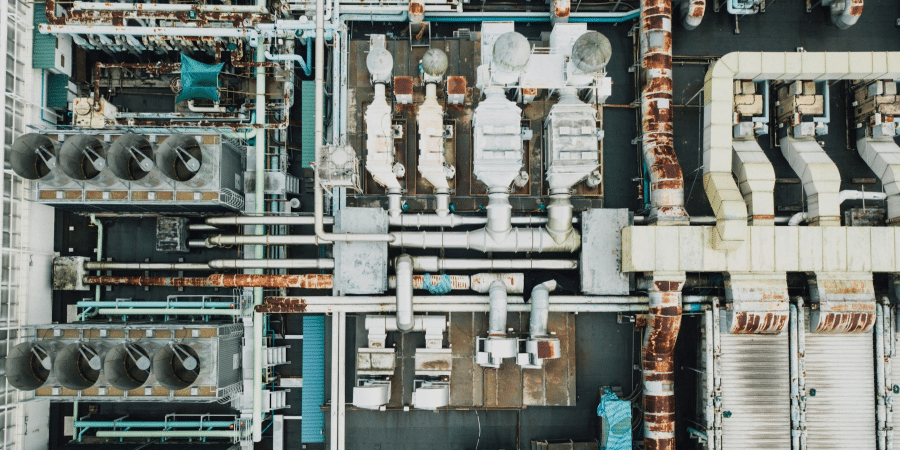

- Access to Business Financing Options

Businesses frequently need access to additional capital in addition to their regular budgets to finance expansion, inventory control, or unplanned emergencies. In these circumstances, having a credit card might be a useful financing instrument. By doing so, you can acquire a line of credit quickly and easily without having to go through the drawn-out loan approval procedure. Additionally, prudent credit card use can improve your company’s credit standing, improving your chances of obtaining future larger loans or other financing choices.

- Enhanced Purchase Protection and Expense Tracking

Business credit cards frequently have extra features and advantages that help safeguard your purchases and simplify expenditure reporting. Numerous cards provide purchase insurance, fraud protection, and extended warranty coverage. These features can protect your company from subpar goods or fraudulent transactions, giving you peace of mind and possibly saving you money. It is also simpler to track and classify costs for bookkeeping and tax purposes thanks to the precise transaction records provided by credit card statements and online account management tools.

Summing it up

Utilizing the advantages of a credit card can offer many benefits, even though prudent financial management is essential for any organization. A credit card can be an useful tool for entrepreneurs in many ways, including building business credit, segregating personal and business expenses, managing cash flow, and accessing financing possibilities. The value of company credit cards can increased by rewards programs, purchase protection, and spending tracking capabilities. To fully enjoy the benefits without incurring extra debt, it is crucial to use credit cards responsibly, make your payments on time, and refrain from carrying large amounts. You may build a strong foundation for financial success and set up your firm for growth by getting a credit card as soon as you launch it.