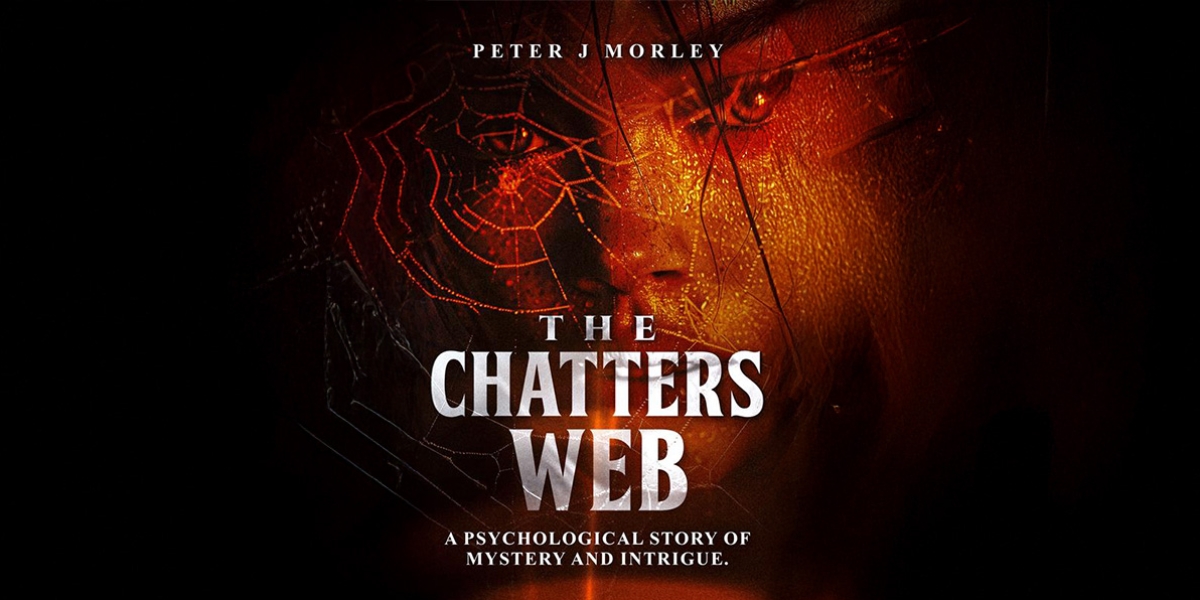

The Hidden Dangers of Words and How Conversations Can Manipulate and Influence Us: A Look at The Chatters Web

By: Rebecca V. Armstead

Words hold significant influence. They can heal or harm, inspire or dismantle, liberate or confine. But what happens when words are used not to connect, but to mislead? Conversations, which are often viewed as casual exchanges, can sometimes evolve into tools of manipulation. They have the potential to subtly guide thoughts, emotions, and even actions.

Peter J. Morley’s The Chatters Web takes readers deep into this concerning reality, where conversations are not just words—they are powerful tools. The book explores how words can construct a deceptive framework of influence, which can quietly entrap unsuspecting individuals, much like in real life.

The Subtle Art of Manipulation

Manipulation is not always immediately visible. At times, it is veiled behind kind words, carefully structured phrases, or misleading half-truths. In psychological manipulation, language can distort reality, prompting people to doubt their own perceptions and decisions.

For instance, gaslighting—a form of manipulation that causes an individual to question their memories or feelings—relies entirely on language. Phrases like, “You’re overreacting,” “That never happened,” or “You’re imagining things” may seem harmless but can erode confidence, leading victims to rely on the manipulator’s version of events.

In the book, the characters experience these mind games firsthand, demonstrating how easily one can be misled by carefully chosen words that obscure the truth. It encourages readers to reflect: How much of what we hear is genuinely truthful, and how much might be a carefully hidden form of control?

The Illusion of Choice

True manipulation often provides a false sense of autonomy. Have you ever been in a conversation where, no matter which option you chose, the end result was the same? This strategy, known as “forced choice,” ensures that no matter what decision you make, the manipulator retains control over the situation.

In the book, the protagonist is involved in conversations that seem innocuous at first but are, in fact, psychological traps. The antagonist’s words reshape reality, blurring the line between truth and falsehood. It serves as a stark reminder that conversations can shape outcomes, often without the listener even realizing they are being influenced.

Breaking Free from Verbal Traps

How can we protect ourselves from manipulative language? Awareness is a crucial first step. Recognizing the tactics employed in deceptive conversations—such as guilt-tripping, twisting words, or creating false urgency—can help us regain a sense of control.

Here are a few ways to defend against manipulation:

- Trust your instincts. If something feels off in a conversation, it’s important to pay attention to that intuition.

- Question inconsistencies. Manipulators often alter details subtly over time. Being aware of these changes can help you recognize manipulation.

- Set boundaries. You have the right to step back from conversations that feel coercive or deceptive.

- Seek a second perspective. Talking to others can provide clarity on whether you are being influenced inappropriately.

Just like in The Chatters Web, the characters who learn to challenge what they hear are the ones who ultimately find the truth. The book stands as both an engaging read and a valuable reminder of the importance of recognizing verbal manipulation.

Takeaway

Are you prepared to explore a world where words might be more powerful than weapons? The Chatters Web will keep you intrigued, questioning every conversation and wondering who you can genuinely trust. If you enjoy psychological twists, hidden motives, and a narrative that will make you rethink communication, this book might be just what you’re looking for. Consider grabbing a copy today and uncover the secrets embedded in The Chatters Web!